🧠 The Illusion of the “News Trade”

Liquidity Hunting is the hidden trap every trader faces. Every trader has been there—eyes glued to the clock, waiting for the Non-Farm Payrolls, CPI release, or a Fed statement. The adrenaline surges. Charts feel alive. Your mind whispers: “This is it. This is the trade that will make me rich.”

Then the numbers hit. The price jumps. Your stop gets smoked. You chase, panic, and wonder why you didn’t win. This is the harsh reality of trading the news: excitement doesn’t equal edge. Most retail traders fall victim to FOMO in trading, while large institutions profit from order flow trading and predictable stop loss hunts.

“By the time retail traders see the news, the market has already moved.” – Anonymous Trading Pro

News trading feels exciting because it’s fast, dramatic, and measurable. But excitement doesn’t equal edge. In fact, it’s the perfect trap.

🎯 Why Retail Traders Keep Falling for It

The market’s news moves are already priced in long before the official release. Here’s what really happens behind the scenes:

Institutional Anticipation: Banks, hedge funds, and proprietary trading desks have massive resources, advanced algorithms, and real-time data feeds. They often predict outcomes hours in advance.

Liquidity Hunting: Smart market makers and high-speed algorithms exploit these events to flush weak hands. They capture liquidity from stop loss hunts and margin calls, leaving retail traders exposed.

Delayed Retail Reaction: By the time most traders react, they become the “bag holders,” absorbing leftover volatility and chasing momentum.

Imagine a wave: institutions are already surfing at the crest, profiting smoothly. Retail traders? They’re running toward the shore, thinking they’re ahead—only to find the wave has already passed. This is the harsh reality of trading the news and falling for FOMO in trading.re, thinking they caught it first. By the time they reach the peak, the wave has already passed.

📊 The Mechanics Behind News Moves

1. Pre-News Positioning

Hours before the headline hits:

- Algorithms scan forecasts: They know what numbers the consensus expects.

- Options markets adjust: Implied volatility shifts, skewing potential moves.

- Liquidity is stacked: Large players place hidden orders near expected breakout levels.

By the time a news release occurs, most of the initial move has already been “priced in.”

2. The Release Spike

Retail traders see a sudden spike. This is often a short-lived liquidity grab:

- Price may jump or drop dramatically in seconds.

- Spreads widen. Slippage increases.

- Stop losses are triggered en masse.

Most retail traders react emotionally, buying into the spike or selling into the dip. Guess who profits? The institutions on the other side.

3. The Fade or Reversion

After the initial move:

- Price often reverts to pre-news levels.

- The retail trader experiences panic or FOMO, chasing losses.

- Liquidity hunters have already exited with profits.

“The news isn’t your edge. Understanding market psychology is.” – Brett Steenbarger

🗺️ The Psychology Trap

Humans are wired to overreact to new information. It’s evolutionary. Our ancestors survived by reacting quickly to threats. But in trading, this instinct is your enemy.

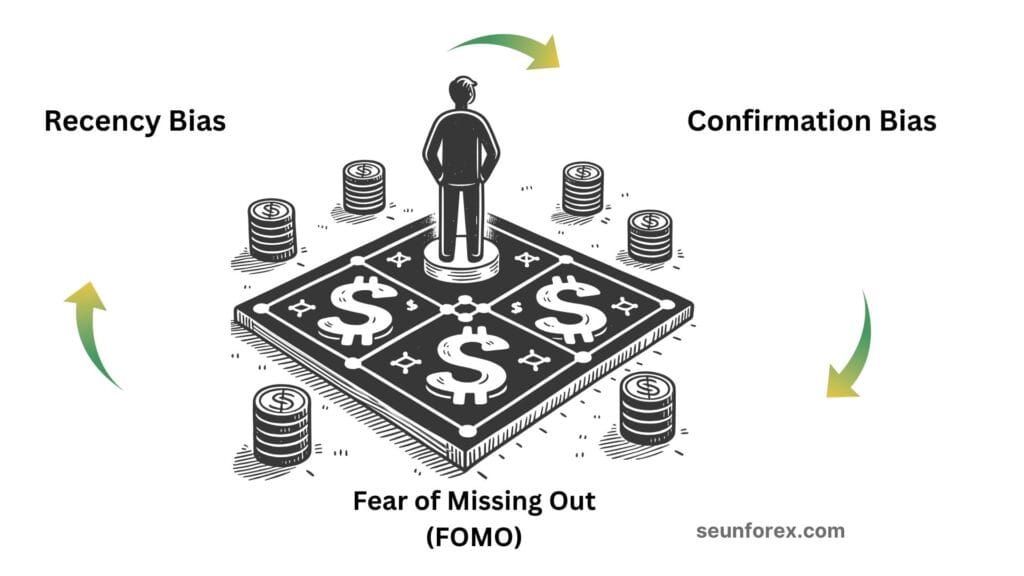

Retail traders fall victim to:

- Recency bias: Believing the latest data is more important than context.

- Confirmation bias: Seeing only what supports your preconceptions.

- Fear of missing out (FOMO): Chasing every spike without a plan.

Scroll Twitter or Reddit during a big news event. Chaos reigns. Traders scream about missing moves, stop-outs, and “manipulated markets.” And the market? It doesn’t care. It moves on, unconcerned with your feelings.

🧩 The Journal Perspective: News vs. Reality

This is where the Wall Street Trader method comes in. Stop reacting — start recording.

A proper trading journal should include news trades, not for bragging, but for self-dissection:

| Field | What to Track |

|---|---|

| Date & Time | When you entered the trade |

| News Type | CPI, NFP, FOMC, Earnings |

| Forecast vs. Reality | Consensus vs. actual |

| Entry Logic | Why did you enter? FOMO or plan? |

| Stop & Target | Was it defined before entry? |

| Outcome | Win/loss, R multiple |

| Emotional State | Fear, greed, panic, excitement |

| Lessons Learned | Pattern recognition for next time |

“A journal doesn’t care if you’re embarrassed. It only cares if you learn.”

Patterns that emerge from consistent tracking:

- Overtrading after spikes

- Chasing reversals prematurely

- Ignoring pre-news liquidity signals

- Entering on hype rather than evidence

📉 Mini-Case Studies: Real News in Action

Case Study 1: Non-Farm Payrolls Mayhem

Event: US Non-Farm Payrolls, 8:30 AM EST

Expectation: +200k jobs

Actual: +210k jobs

Retail reaction: Price jumps 40 pips in EUR/USD. Traders buy on the spike. Stop losses above resistance trigger. Adrenaline surges. Margin calls begin.

Reality: By the time retail entered, institutions had already:

- Taken profits

- Absorbed liquidity from stops

- Adjusted hedges for exposure

Outcome: Most retail traders are short-lived winners or long-term losers.

Case Study 2: CPI Release Chaos

Event: US Consumer Price Index, 1:30 PM EST

Expectation: 0.3% MoM inflation

Actual: 0.5% MoM inflation

Retail reaction: Panic selling hits USD/JPY. Stop-loss clusters trigger, creating a sudden 50-pip spike. Traders chase the dip, expecting continuation.

Reality: Institutions anticipated the move:

- Entered ahead of consensus

- Captured liquidity from retail stops

- Allowed small reversal before trending again

Lesson: Chasing the initial move leads to losses; waiting for post-spike exhaustion and analyzing liquidity zones gives the edge.

Case Study 3: FOMC Rate Decision Frenzy

Event: Federal Reserve Rate Announcement, 2:00 PM EST

Expectation: 25bps hike

Actual: 25bps hike (as expected)

Retail reaction: Buying USD pairs aggressively on headline. Volume surges, spreads widen, stops hit. Many retail traders feel “left behind” and chase at extreme levels.

Reality: Institutions:

- Profited from predictable retail FOMO

- Used algorithmic layering to manage exposure

- Let retail absorb volatility before stabilizing trend

Lesson: Even “expected” news triggers chaotic liquidity hunts. Trading price and order flow beats guessing numbers.

🧠 The Alternative: Trade What You See, Not What You Hear

Pre-Defined Setups: Focus on order flow trading and price action, not the headlines. Look for clear support and resistance levels, and confirm moves with volume before entering.

Wait for Confirmation: Avoid chasing the initial spike. Instead, wait for evidence of exhaustion or a true continuation. This approach prevents losses from common FOMO in trading mistakes.

Manage Risk First: Always define your stop-loss and position size before thinking about profits. Protecting capital is key, especially during liquidity hunting events.

“The market doesn’t care about the news. It only cares about liquidity.”

🚀 The Elite Trader’s Mindset Shift: From Victim to Strategist

The illusion of the “news trade” ends here. You’ve learned that the market already knew. Your edge now lies in exploiting the predictable chaos. Stop reacting emotionally to headlines and start acting strategically based on price, liquidity, and discipline.

🎯 The New Playbook: Action Checklist

| Focus Area | Retail Trader (The Trap) | Elite Trader (The Edge) |

|---|---|---|

| Pre-Event Prep | Stares at the clock, guesses the number. | Maps Liquidity Zones (stop clusters, prior S/R) and defines risk ($0.5%-1%$ R). |

| The Event | Chases the Spike (FOMO entry on the headline). | Observes First, Trades Later. Waits for the initial spike to exhaust and liquidity to be hunted. |

| Execution | Uses wide stops; enters with emotion; ignores slippage. | Trades the Aftermath. Enters with evidence (order flow, volume confirmation) and a defined R multiple. |

| Core Belief | News is the Cause of movement. | News is the Spark; Liquidity is the Fuel. Price action is the only oracle. |

| Learning | Yells about manipulation on Twitter/Reddit. | Journals Every Move (emotional state, R-multiple outcome, market reaction) for pattern recognition. |

✅ Final Key Takeaways: Discipline Over Drama

- Liquidity is King: Trade what the market does, not what the news says. Focus on liquidity zones and order flow trading traps.

- Patience > Hype: Wait for the initial chaos to settle. Enter only when risk/reward is clearly defined.

- Risk First: Risk management is non-negotiable. Always set position size based on structure, not emotion.

- Mindset Matters: Treat news as data, not drama. Recognize predictable patterns, not headlines.

“The market doesn’t reward excitement. It rewards preparation and discipline. The market already knew—your job is to act smarter.”

💡 Pro Tip for Practice

“Even with a strong strategy, test this approach. Use your 100k demo account to practice waiting out the initial 5-minute spike during NFP or FOMC before taking any action. This protects your capital while developing your timing.”