“The greatest obstacle to discovery is not ignorance—it is the illusion of knowledge.”

- — Daniel J. Boorstin

The Forex Truth the gurus never talk about isn’t hidden in a secret indicator, a magical Fibonacci setup, or a paid mentorship. It’s buried beneath layers of marketing, illusion, and noise — the same noise that keeps thousands of traders chasing dreams instead of results.

You’ve seen the reels — the shiny cars, the poolside laptops, and the “freedom lifestyle” that screams success. The so-called experts claim they’ve mastered Forex trading, but the real Forex Truth is that most of them profit not from the markets… but from you.

Because the market doesn’t reward flash — it rewards discipline. And understanding the Forex Truth means stripping away everything that doesn’t serve your growth. It’s not about discovering a secret; it’s about uncovering the simplicity they’ve buried under layers of hype.

The truth they hide isn’t complex — it’s subtraction. It’s not about what you add to your trading; it’s about what you remove.

Part 1: The Setup – The Story They Sell

The narrative is airbrushed and perfect. It follows a three-act structure straight out of a Hollywood script.

Act I: The Struggle. The guru was once like you. Stuck in a dead-end job. Drowning in debt. Feeling the soul-crushing weight of the 9-to-5. He was the protagonist in a story he didn’t control.

Act II: The Discovery. He finds Forex. Or, more accurately, he finds a “mentor” or a “secret method.” He learns the “real way” the market works—the way “they” don’t want you to know. This is the montage scene. The late nights. The scribbled notes. The “aha!” moment.

Act III: The Redemption. The money. The freedom. The respect. The story concludes with the hero having conquered the financial markets. The final scene is him on a beach, checking his trades. Roll credits.

This story is designed to do one thing: trigger the Cinderella Complex. The deep-seated belief that a external force—a prince, a guru, a system—will swoop in and rescue you from your financial reality.

It’s a fairy tale.

And you are not Cinderella. The market is not your prince. It’s a dragon. And the gurus are selling you a plastic sword, telling you it’s Excalibur, while they collect a fee from the dragon’s treasure hoard.

Part 2: The Subtraction – The “Secret” They Bury

So, what’s the hidden truth? If it’s not a magical tool, what is it?

It’s subtraction.

Not addition.

The gurus make their money by adding complexity to your life. More indicators. More webinars. More signals. More fear of missing out. Their entire business model is built on the premise that you lack something, and they have it.

The profound, liberating, and brutally unsexy truth is this:

Consistent profitability in Forex is not about finding the perfect entry. It’s about mastering the art of the exit.

Let that sink in.

While you’re obsessing over the green candle that will launch your career, the pros are obsessing over the red candle that will end it. Your focus is on winning. Their focus is on surviving.

This is the core subtraction. You must subtract:

- The Need to Be Right. Your ego is your worst trading partner. It will hold onto a losing trade hoping it will break even (so you can feel “right”), and it will close a winning trade too early to lock in a profit (so you can feel “smart”). The market doesn’t care about your ego. Subtract it.

- The Noise. The 14 different indicators on your chart are all derived from two things: price and volume. They are lagging. They conflict. They paralyze. They are clutter. Subtract them.

- The “All-In” Mentality. This isn’t a casino. This is a probability game. Betting your entire account on one “sure thing” is a story, not a strategy. It’s a terrible story with a predictable ending. Subtract the gamble.

What are you left with when you strip all this away? The bare, unvarnished, terrifyingly simple framework of a professional.

Part 3: The Wall Street Style – The Engine of Extraction

Don’t be fooled by the Instagram flex. The real “Wall Street Style” isn’t about flash. It’s about machinery. It’s about cold, unemotional, systematic extraction of value from market inefficiencies.

Think of it like this: You’re not a gladiator in the arena. You’re the bookie.

The bookie doesn’t care who wins the big game. He just sets the odds so that no matter the outcome, he makes a profit. That’s the professional mindset.

This approach is built on three pillars they never emphasize enough — and if you want a deeper dive into how professional traders implement these principles with precise exit strategies, check out this article on trading exit strategy, discipline, and expectancy.

Pillar 1: Risk of Ruin (The Math They Hate)

This is the single most important concept you will ever learn — more important than any candlestick pattern.

According to Investopedia’s definition of Risk of Ruin, it’s the statistical probability of losing your entire trading capital.

The gurus don’t talk about this because it’s boring. It’s math. It doesn’t sell. But it’s the bedrock of every fund, every institution, every professional trader on the planet.

Here’s the punchy takeaway: If you are not calculating your Risk of Ruin, you are not trading. You are donating.

The professional rule is simple: Never risk more than 1–2% of your account on a single trade.

Let’s do the math they don’t want you to see. If you risk 5% per trade (a common “go big or go home” mentality), a string of just 10 losses — which happens to everyone — wipes out nearly 50% of your capital. Good luck recovering from that.

If you risk 1%, that same string of 10 losses is only a 10% drawdown. Unpleasant, but not fatal. You live to fight another day.

This isn’t a “tip.” This is the law. Your first, last, and only non-negotiable rule

Pillar 2: The Edge (The Story of Probability)

“But how do I make money only risking 1%?” you ask.

This is where the Forex Truth becomes crystal clear — it’s not about luck, leverage, or chasing high win rates. It’s about understanding your edge.

And no, your edge isn’t a 100% win rate.

An edge is simply a repeatable set of conditions that, over a large number of trades, gives you a statistical advantage.

Think of it like a coin — but not a fair one. Your mission as a trader is to find a coin weighted 55/45 in your favor. That slight 5% imbalance is your edge, and it’s everything.

On any single flip, you could lose. But over 100 flips? 1000 flips? The law of large numbers guarantees your profitability — if you stick to the plan.

That’s the Forex Truth the gurus won’t sell you: trading success doesn’t come from perfection. It comes from consistency, math, and patience.

Your trading strategy — your “system” — is just your method of finding that slightly weighted coin. It could be a price action setup, a support/resistance bounce, or a moving average crossover. It doesn’t matter as long as it’s definable, testable, and repeatable.

The guru sells you a fantasy of a 90% win rate. The professional celebrates a 55% win rate — with a solid risk-to-reward ratio and unshakable discipline.

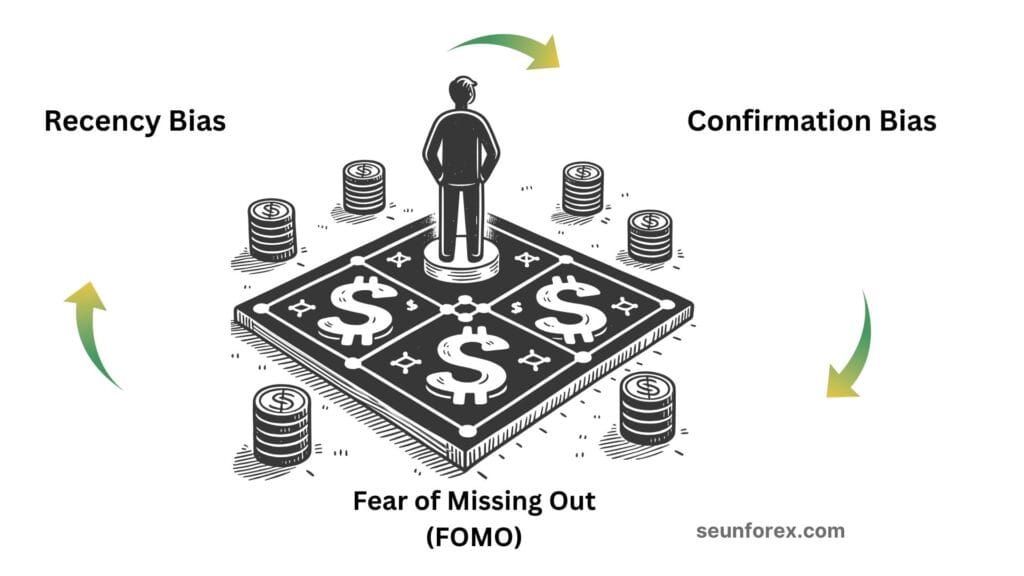

Pillar 3: Psychology (The Battle You Didn’t See Coming)

You can have the perfect risk management and a proven edge, and still blow up your account.

Why?

Because the final boss in this game isn’t the market. It’s the six inches between your ears.

Trading is a constant cycle of two emotions: Greed and Fear.

- Greed makes you abandon your 1% rule and go “all in” on a “sure thing.”

- Greed makes you hold a winning trade too long, turning a profit into a loss.

- Fear makes you close a winning trade too early, leaving a mountain of money on the table.

- Fear makes you hesitate on a valid setup, missing your edge entirely.

The professional’s mind is a sterile lab. The retail trader’s mind is a theme park of emotional rollercoasters. The professional has a trading plan and follows it like a robot. The retail trader has a “feeling” and follows it off a cliff.

Part 4: The Punchy Storytelling – A Day in the Trenches

Let’s make this real. Let’s subtract the glamour and tell the Forex Truth — the real story of a disciplined trader, not the fantasy the trading gurus post on Instagram.

6:45 AM: The alarm goes off. No beach. No Bali. No champagne breakfast. Just a home office.

The first action isn’t opening the charts — it’s reviewing the trading plan, re-reading the rules, and re-affirming the 1% risk rule. This mental ritual is the true core of trading psychology. Before touching a single trade, he strengthens his mindset.

7:30 AM: The London session opens. The charts are clean — no rainbow indicators, no chaos. Just pure price action, one moving average, and carefully drawn support and resistance levels. The trader waits. This is 90% of the job: patience, not prediction.

9:15 AM: A setup forms. Price touches a key support and shows a rejection candle. It matches his edge — his defined forex strategy. His pulse rises slightly. This is the moment.

The disciplined trader doesn’t “hope.” He executes.

He calculates his position size based on his stop loss distance — ensuring it represents exactly 1% of his capital.

He sets his stop loss (his insurance policy).

He sets his take profit — a 1:1.5 or 1:2 reward ratio.

This is professional execution.

This is Risk of Ruin management in real time.

This is the Forex Truth in motion.

9:16 AM: The trade is live. Now comes the hardest part: doing nothing.

He doesn’t watch every tick. He doesn’t move his stop loss. He doesn’t close early out of fear.

He knows his job is to execute the process — not chase the outcome.

The machine is running. The system is doing the work.

11:00 AM: The trade hits stop loss. A 1% loss. No panic.

He doesn’t curse, doesn’t seek revenge on the market.

Instead, he opens his trading journal and writes:

“Trade #347. Short GBP/USD. Setup A. Stopped out. -1%. Notes: Clean execution. No emotional error.”

Then he closes the book. The loss is data — not identity.

This is what separates emotion from performance — the essence of trading psychology.

2:00 PM: Another setup. He executes again with robotic precision. Same 1% risk, same rules.

4:30 PM: The second trade hits take profit — +1.5%.

End of day.

He’s up 0.5%. No yacht, no fireworks — just quiet satisfaction.

Because this is the Forex Truth the trading gurus don’t show you: success isn’t built on hype, it’s built on control.

He didn’t “win big.” He survived smart.

He followed his process.

He protected his capital.

He refined his forex strategy and strengthened his discipline.

He controlled what he could — his risk, his execution, his emotions — and subtracted everything else.

This is the real story of trading psychology in motion — one of patience, probability, and professionalism.

It’s not the kind of story that sells $2,997 courses.

But it’s the only story that leads to real, lasting profitability.

That’s the Forex Truth that actually matters.

Part 5: Your Final Takeaway – The One-Page Action Plan

The truth is out. The curtain has been pulled back. The gurus’ secret is that there is no secret. It’s subtraction and discipline.

Your journey doesn’t start with a purchase. It starts with a purge.

Here is your punchy, one-page action plan. Do this before you place another trade.

Phase 1: The Purge (This Week)

- Unsubscribe. Go through your email and social media. Unfollow every “guru” who leads with lifestyle, Lambos, and “easy money.” Their content is psychological poison.

- Simplify Your Chart. Open your trading platform. Remove every single indicator. All of them. You are left with a blank candlestick chart. This is your new canvas.

- Write Your “Risk of Ruin” Rule. On a piece of paper, write: “I will never risk more than 1% of my total account equity on any single trade.” Sign it. Tape it to your monitor.

Phase 2: The Foundation (The Next Month)

ThisThis is where the Forex Truth begins to take shape. You’ve stripped away the noise and hype sold by the trading gurus, and now it’s time to build a real foundation like a professional — not a gambler.

1. Learn Price Action

With a clean chart, learn to read what price is actually telling you. No indicators. No unnecessary tools. Just the market’s raw story.

Understand what support and resistance truly mean. See how highs and lows reveal the emotional rhythm of buyers and sellers — the true trading psychology behind every candle.

This is where the forex strategy becomes simple yet powerful. It’s not about predicting the market — it’s about interpreting it.

This clarity in price action becomes your new edge — your personal blueprint for consistent growth.

2. Build a Simple Plan

Create a trading plan so clear it almost feels boring — because simplicity scales.

Define one or two setups you’ll trade, and commit to them.

For example:

- “I will buy on a bounce from the 200 EMA if structure aligns.”

- “I will sell if price breaks and retests this key support level.”

This step separates professionals from dreamers.

Write down every rule — entry, stop loss, and take profit.

This is how you protect your capital, reduce your Risk of Ruin, and begin to act like the trader the Forex Truth demands you become.

3. Journal Relentlessly

Every single trade deserves a note.

Document the setup, the reasoning, the outcome, and — most importantly — your emotions.

At the end of each week, don’t just analyze the market; analyze yourself.

That’s the real data that builds your trading psychology and sharpens your discipline over time.

Phase 3: The Execution (Forever)

This is where the Forex Truth hits hardest. The real difference between amateurs and professionals isn’t intelligence — it’s discipline and execution.

1. Become the Robot

Your mission is simple: follow your plan.

No deviations. No impulsive “gut feelings.” No revenge trades.

If the setup matches your plan — trade it.

If it doesn’t — walk away.

Your success isn’t about guessing right; it’s about executing your forex strategy with precision.

The professional trader doesn’t chase excitement; they chase consistency.

2. Measure in Months, Not Trades

The market rewards patience, not impulse.

One winning trade means nothing. Ten trades mean very little.

Judge your progress across a larger sample — 50 or 100 trades — because only then does your edge reveal itself.

Ask yourself weekly:

- Am I following my plan with discipline?

- Is my Risk of Ruin under control?

- Is my data confirming my strategy?

- Am I improving my trading psychology or reacting emotionally?

The Final Forex Truth

Here’s what the trading gurus never tell you:

The market isn’t a place to get rich quick — it’s a place to get poor quick if you’re reckless.

But for those who master patience, simplicity, and subtraction, the market becomes a system — a forex strategy that compounds confidence and capital.

The choice is yours.

Keep buying the dream… or start building the discipline.

Subtract the noise.

Embrace the process.

Become the bookie, not the gambler.

That’s the Forex Truth that actually matters.