🧠 From Lagos to Wall Street: How Nigerian Traders Rewire Their Minds with Exness

Trading is more than just charts and indicators; it’s a battle waged in the mind. The most successful traders, from the bustling markets of Lagos to the financial hubs of Wall Street, have one thing in common: they’ve mastered their psychology. They understand that a broker like Exness Nigeria isn’t just a platform—it’s a partner that either supports or sabotages their mental game. A top-tier broker provides the tools and stability needed to transform a reactive, emotional mindset into a disciplined, strategic one.

For Nigerian traders, navigating the complexities of the global financial markets demands a broker that genuinely understands their unique needs. Exness Nigeria delivers solutions from local payment methods to a transparent and trustworthy trading environment. In this comprehensive guide to Exness Nigeria, we will show you why it has become a leading choice for Nigerian traders and how its features can help you overcome common psychological hurdles to achieve your trading goals. We cover every aspect of Exness Nigeria’s offerings—from account types to trading strategies—ensuring you have all the information you need to make an informed decision.

Ready to start your journey to disciplined trading? Click here to sign up with Exness Nigeria and get started on your trading journey.

📌 Section 1: What is Exness?

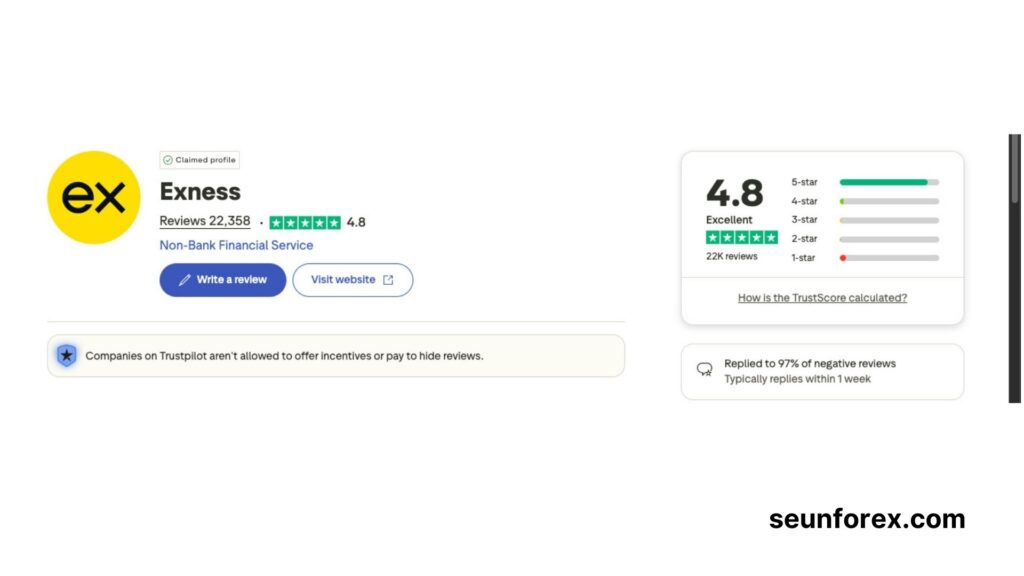

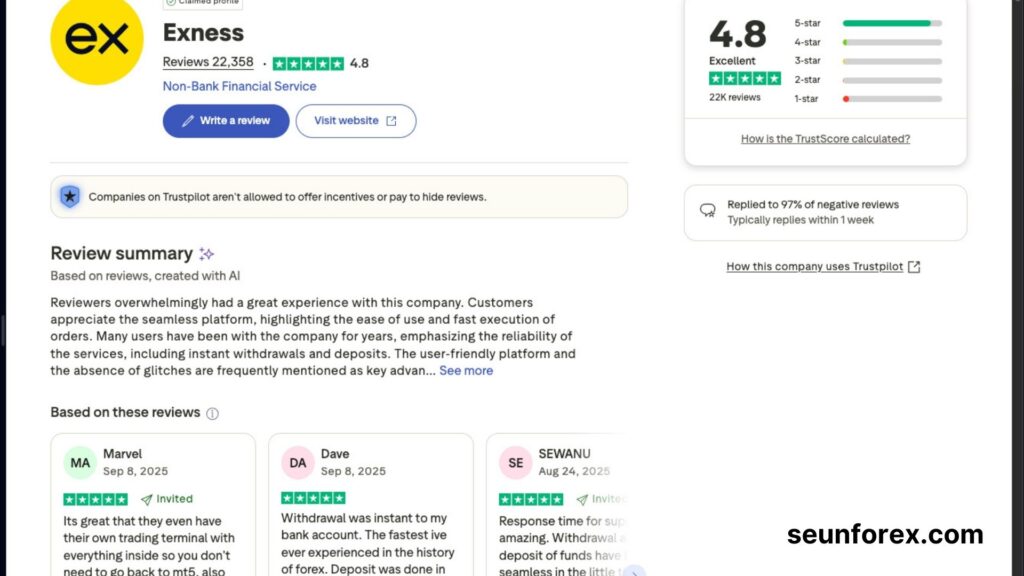

Exness is a global multi-asset broker that has been a significant player in the financial markets since its founding in 2008. With its headquarters in Cyprus, it has built a global reputation for reliability, competitive trading conditions, and a strong commitment to transparency.

The company is regulated by multiple esteemed international bodies, which provides a solid layer of trust and security. These include:

- Cyprus Securities and Exchange Commission (CySEC): A key regulator within the European Union, ensuring compliance with strict financial standards.

- Financial Conduct Authority (FCA): The top-tier financial regulator for the UK, known for its rigorous oversight.

- Financial Sector Conduct Authority (FSCA): The market conduct regulator in South Africa, which is a major financial hub on the African continent.

- Other global licenses from the FSC in the British Virgin Islands, FSC in Mauritius, and the FSA in Seychelles, allowing Exness to serve a vast network of clients worldwide.

While this global regulatory framework provides a foundation of security, the broker’s success in Nigeria stems from its tailored approach. Exness has invested heavily in understanding and serving the specific needs of the Nigerian trading community, establishing a strong local presence without a physical office in the country.

📌 Section 2: Exness Nigeria – The Local Angle

The most critical question for any Nigerian trader is, “Does this broker truly work for me?” Exness has addressed this by providing solutions that make it feel like a local broker.

Does Exness Have an Office in Nigeria?

No, Exness does not operate a physical office in Nigeria. It’s important to understand that many international brokers adopt this model to optimize resources and focus on providing excellent online support and transaction efficiency. Instead, Exness maintains a strong presence through participation in local seminars, expos, and direct engagement with the Nigerian trading community online. This allows them to allocate resources to what matters most to traders: fast transactions, low costs, and high-quality customer support.

Minimum Deposit in Nigeria

One of the most appealing features for new traders is the low barrier to entry. Exness offers a flexible minimum deposit policy, which can be as low as $10 USD for its popular Standard and Standard Cent accounts. This amount, which is dependent on your chosen payment method, is easily affordable for beginners. The ability to start with a small capital base allows you to test the platform and build confidence without taking on significant financial risk.

How to Deposit (Bank Transfer, Fintech Apps, Cards, Crypto)

Exness is a leader in payment flexibility. Recognizing the importance of seamless, fast, and local transactions, the broker offers a variety of deposit methods tailored for the Nigerian market, all designed to make funding your account as easy as possible. These include:

- Local Bank Transfers: This is the most widely used and convenient method. You can fund your account directly from your Nigerian bank account (e.g., GTBank, UBA, Zenith). These transactions are typically processed instantly, ensuring you can capitalize on market opportunities without delay.

- Fintech Apps: Exness often integrates with popular local fintech services and payment gateways to provide an even more convenient deposit experience.

- Credit/Debit Cards: You can use your Visa or Mastercard for instant deposits, though some banks may have restrictions on international transactions.

- Cryptocurrency: For those who prefer decentralized options, Exness supports crypto deposits (e.g., Bitcoin, USDT), offering a fast and secure alternative to traditional banking.

How to Withdraw (Naira Withdrawals, Speed, Charges)

This is where Exness truly sets itself apart. The broker is famous for its near-instant withdrawals, with most transactions processed within minutes or even seconds. Exness also allows for Naira withdrawals, meaning you can receive your funds directly in your local bank account without the hassle of currency conversion or high fees. The broker prides itself on offering zero or very low fees for both deposits and withdrawals, a huge benefit that can save traders a significant amount of money over time.

Countries Banned from Exness (Important Compliance Note)

While Exness serves traders globally, it adheres to international regulations and does not provide services in certain jurisdictions, including the United States, Japan, and most of the European Union for retail traders. These restrictions are in place to comply with different regulatory frameworks. As a Nigerian trader, you can be confident that your location is fully supported and the platform is accessible to you, but being aware of these global compliance rules is a good practice.

📌 Section 3: Pros and Cons of Exness Nigeria

Like any broker, Exness has its strengths and weaknesses. Understanding them allows you to use the platform to your maximum advantage while mitigating potential risks.

Pros ✅

- Low and Stable Spreads: Exness Nigeria is renowned for offering some of the lowest spreads in the industry, especially on its Pro, Raw Spread, and Zero accounts. This is a game-changer for Nigerian traders, as tight spreads mean lower trading costs, which directly translates into higher profit potential over time.

- Fast and Fee-Free Withdrawals: One of the biggest advantages of Exness Nigeria is the ability to withdraw funds instantly into your Nigerian bank account with no charges. This feature provides a massive confidence boost, eliminating the frustration of long waiting times and unexpected fees, and making your trading capital truly accessible.

- Multiple Account Types: Exness Nigeria offers a variety of accounts—Standard Cent, Standard, Pro, Raw Spread, and Zero—that cater to every type of trader. Beginners can start with the Standard Cent account with a very small deposit, while professional traders can use the Raw Spread account to access the lowest possible spreads. This flexibility ensures that Exness Nigeria can grow with you throughout your trading journey.

- High Leverage: Exness Nigeria provides some of the highest leverage options available, including unlimited leverage under specific conditions. While leverage carries risk, it allows traders with smaller capital to take on larger positions, potentially magnifying profits.

- Reliable Customer Support: Exness Nigeria offers 24/7 customer support in multiple languages, ensuring help is always available. For traders in the fast-moving Nigerian market, this constant support is invaluable.

- Islamic/Swap-Free Accounts: Exness Nigeria provides Islamic accounts that are swap-free, which is crucial for Muslim traders who follow Sharia law and cannot pay or receive interest (swaps) on overnight positions.

Cons ❌

- Restrictions on News Trading: While Exness Nigeria is known for fast execution, some professional account types may have restrictions during periods of high market volatility, such as major news releases. This can affect traders who rely heavily on high-impact news trading strategies.

- High Leverage Risk: The high leverage offered by Exness Nigeria, while a pro, is also a risk. It can quickly amplify losses if not managed properly. Despite negative balance protection, disciplined risk management is essential to avoid losing your entire capital.

- Regulatory Differences: Although Exness Nigeria is regulated by top-tier international bodies, it does not hold a license from the Central Bank of Nigeria (CBN). This means your funds are protected by international regulations but not directly overseen by Nigerian authorities. For some traders, this may be a concer

📌 Section 4: Trading Psychology Meets Broker Choice

Your broker is more than just a platform; it is a critical part of your trading psychology toolkit. The features a broker offers can either support your mental game or undermine it.

- Active vs. Reactive Thinking: A reactive trader is constantly chasing the market, making impulsive decisions based on emotion. An active trader, on the other hand, waits for a plan to come together and executes it with discipline. Exness’ fast withdrawal process and stable spreads support active thinking. The knowledge that you can access your money quickly reduces the psychological pressure to “force” a profit, giving you the patience to wait for the right setup.

- Ego vs. Humility: A trader’s ego is a major enemy. It makes them hold on to losing trades, hoping they will turn around, or refuse to admit they were wrong. Exness’ negative balance protection and clear risk management tools act as a safety net that encourages humility. Knowing that you cannot lose more than you deposited allows you to focus on managing your trades responsibly, rather than worrying about debt.

- Risk vs. Calculated Risk: Trading is inherently risky, but the difference between a successful trader and a losing one is whether the risk is calculated. Exness provides an array of tools that help you quantify risk, such as their margin and pip calculators. Using these tools to pre-determine your position size based on your 1-2% risk per trade rule transforms your trading from a gamble into a calculated business decision. A professional trader doesn’t just place a trade; they size it correctly and know their risk-to-reward ratio before they even click the button.

Ready to start trading with a broker that supports your mental game? Click here to sign up with Exness Nigeria and get started on your trading journey.

📌 Section 5: Step-by-Step – How to Start with Exness Nigeria

Getting started with Exness is a straightforward process designed to get you trading quickly.

Step 1: Create Account

Visit the Exness website and click the “Open Account” or “Register” button. You will be asked to select your country of residence (Nigeria), enter your email address, and create a strong password. This initial step creates your Personal Area (PA), which is the central hub for all your trading activities.

Step 2: Verify with BVN/ID

To unlock all features and lift deposit/withdrawal limits, you must complete your account verification. This involves two parts: identity verification and residence verification.

- Identity Verification: You can use a government-issued ID like your National ID Card, Voters Card, or International Passport.

- Proof of Residence: A utility bill (electricity, water) or a bank statement showing your residential address is typically required.For Nigerian traders, Exness often uses the Bank Verification Number (BVN) for a fast and seamless verification process, making it much more convenient than a manual document upload.

Step 3: Fund Account (Naira Deposit Methods)

Once your account is verified, you can make your first deposit. Head to the “Deposit” section in your Personal Area. Select a local payment method, such as a local bank transfer. Enter the amount you wish to deposit in Naira. The system will automatically convert this to your trading account currency (e.g., USD or USD Cents) at a favorable rate. The funds will be credited to your trading account instantly or within minutes.

Step 4: Choose MT4/MT5

Exness offers two of the most popular trading platforms: MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

- MT4 is the industry standard for forex trading. It is user-friendly, lightweight, and has a vast community with thousands of custom indicators and Expert Advisors (EAs). If you plan to focus on forex, MT4 is an excellent choice.

- MT5 is a multi-asset platform. It’s more advanced, offering more indicators, more timeframes, and the ability to trade stocks, indices, and cryptocurrencies in addition to forex. If you want a more diverse trading experience beyond just currency pairs, MT5 is the superior option.

Step 5: Place Your First Trade

After funding your account and choosing your platform, you can place your first trade. Start with a very small position size, especially on a Standard Cent account. This allows you to get a feel for the platform and the market without risking significant capital.

📌 Section 6: Exness Accounts Compared (Nigeria Version)

Exness offers a diverse range of account types to suit different trading styles and experience levels.

- Standard Cent: The perfect account for beginners. The minimum deposit is very low, and trades are executed in cents, which minimizes risk. This is the ideal sandbox for new Nigerian traders to practice their skills on a live market without the pressure of a large capital base.

- Standard: The most popular account. With a low minimum deposit, no commission on trades, and stable spreads, it’s a great all-around option for both new and intermediate traders.

- Pro: Designed for experienced traders who require instant execution and tight spreads without paying a commission. This account is suitable for those who prioritize speed of execution and are not scalping frequently.

- Zero: This account offers zero spreads on the top 30 trading instruments 95% of the time, with a small commission per lot. It is ideal for scalpers and high-frequency traders who need the tightest possible spreads to capitalize on small price movements.

- Raw Spread: This account also features razor-thin spreads (starting from 0.0 pips) but has a fixed, low commission per lot. It is another excellent choice for professional traders who demand the lowest possible spreads and a transparent commission structure.

For Nigerian traders, the key is to match your account type to your strategy and risk tolerance. A beginner with a demo account might start with the Standard Cent account to transition to real money trading, while someone with more experience might jump straight to a Standard or even a Pro account.

Ready to find the perfect account for your trading style? Click here to sign up with Exness Nigeria and get started on your trading journey.

📌 Section 7: Common Questions Nigerians Ask About Exness

Here is a quick-reference FAQ section to answer the most pressing questions from the Nigerian trading community.

- Is Exness legal in Nigeria?Yes, Exness is a legitimate and trusted international broker. While it doesn’t have a direct license from the Central Bank of Nigeria (CBN) for forex trading, this is the case for most international brokers. Exness operates legally and has a strong global regulatory framework, which offers a high degree of protection to its clients.

- How do I deposit with GTBank/UBA/Opay?Exness supports local bank transfers from a wide range of Nigerian banks. You will initiate the deposit from your Personal Area on the Exness website or app. You will then be provided with the details to make a transfer from your bank account or through your bank’s app. The process is instant and seamless.

- What is the withdrawal time?Exness is famous for its near-instant withdrawals. Most withdrawals are processed automatically and can be received in your account within minutes. The speed may depend on your bank’s processing time, but Exness’s side of the process is almost always immediate.

- Can I use Naira directly?Yes, you can. Exness allows you to deposit and withdraw funds directly in Naira using local payment methods. The funds will be converted to your trading account’s currency (e.g., USD) at a favorable exchange rate upon deposit.

- Does Exness offer Islamic/swap-free accounts?Yes, Exness offers swap-free accounts for traders who cannot receive or pay swaps due to their beliefs. This is a standard feature on most Exness account types and can be activated easily.

- What is the minimum lot size?On a Standard account, the minimum lot size is typically 0.01 (one micro lot). On a Standard Cent account, the minimum is also 0.01, but since it’s in cents, the actual capital risk is significantly lower, making it perfect for beginners.

- Is Exness better than OctaFX/Deriv/HotForex in Nigeria?While these are all popular brokers in Nigeria, Exness often stands out due to its superior withdrawal speed, more consistent spreads, and diverse account offerings. The low-cost, instant withdrawal feature is a major differentiating factor that gives Exness a competitive edge.

📌 Section 8: Exness vs Other Brokers in Nigeria

When choosing a broker, a direct comparison is crucial. While many brokers are popular in Nigeria, they are not all created equal. Here’s how Exness stacks up against other popular brokers in the local market, based on features that matter most to traders.

| Feature | Exness | OctaFX | Deriv | HotForex (HFM) |

| Regulation | CySEC, FCA, FSCA & more | CySEC, FSCA | FSC, SVGFSA | FCA, DFSA, FSCA & more |

| Spreads | Very low, from 0.0 pips | Low, but variable | Variable | Variable, from 0.0 pips |

| Withdrawals | Near-instant, often in minutes | Can take up to 3 days | Can take up to 1-2 days | Can take up to 2 days |

| Local Deposits | Local bank transfers, Fintech | Local bank transfers, agents | P2P, local agents | Local agents, bank transfer |

| User-Friendliness | High | High | Good, with advanced features | High |

This table clearly highlights Exness’s primary competitive advantage: withdrawal speed. For many Nigerian traders, the ability to access funds quickly is a top priority, and Exness’s near-instant processing sets it apart from its competitors. The low spreads and wide range of account types also give it a significant edge.

📌 Section 9: Pro Tips for Nigerian Traders Using Exness

Becoming a successful trader requires more than just a good broker; it requires discipline and a solid strategy. Here are some pro tips tailored for Nigerian traders using the Exness platform:

- Avoid Revenge Trading: The markets don’t care about your feelings. If you have a losing trade, don’t immediately jump into another one to try and “win back” your money. Step away from the charts, analyze what went wrong, and wait for a clear, high-probability setup before re-entering.

- Use Exness’ Risk Calculators: Never open a trade without first calculating your potential loss. The Exness platform and app have built-in risk calculators that can help you determine the appropriate position size based on your stop-loss and the percentage of your capital you are willing to risk on a single trade.

- Focus on 1:5 RRR Swing Trades: Instead of trying to scalp for small profits, consider focusing on swing trading with a high Risk-to-Reward Ratio (RRR). Aim for trades where your potential profit is at least five times your potential loss. This strategy allows you to be right only 20% of the time and still be profitable. It also reduces the stress of constant chart monitoring.

- Stay Patient (Don’t Force Trades): The market is always open. There is no need to be in a trade at all times. A large part of being a profitable trader is having the patience to wait on the sidelines for the perfect setup. Use your Exness demo account to practice patience and discipline.

📌 Section 10: Final Verdict – Is Exness Nigeria Worth It?

For Nigerian traders, Exness presents a compelling proposition. It offers the perfect blend of global reliability and local convenience. The broker’s commitment to fast, fee-free Naira withdrawals, combined with its diverse account types and competitive spreads, makes it a powerful tool for traders at all levels.

While no broker is without its drawbacks, the pros of using Exness—particularly for the Nigerian market—far outweigh the cons. Its robust security, excellent customer support, and tailored local solutions address the most common pain points for traders. Whether you’re a complete beginner looking to get started with a small deposit or an experienced professional seeking the tightest spreads, Exness has an account and a set of features that can help you achieve your trading goals.

For a broader perspective on your options, you might also be interested in our analysis of the best forex brokers in Nigeria, including our IC Markets review.

Ready to trade with a trusted broker and experience the difference? Click here to sign up with Exness Nigeria and get started on your trading journey.